Experiencing a total loss, whether it’s your home after a fire, your car after a serious accident, or your belongings swept away by a flood, is an incredibly stressful and often heartbreaking event. In the aftermath, amidst dealing with emotions and immediate safety concerns, one of the most daunting tasks is often confronting the insurance claim process. It requires you to recall, from memory, every single item you’ve lost, its value, and its condition – a nearly impossible feat under pressure.

This is where an organized approach becomes your best friend. Having a comprehensive record of your possessions can significantly ease the burden of filing an insurance claim, ensuring you don’t overlook valuable items and receive the compensation you deserve. A well-prepared total loss inventory list template isn’t just a document; it’s a critical tool for peace of mind and efficient recovery during a challenging time.

Why a Detailed Total Loss Inventory is Crucial for Your Claim Success

When you’ve suffered a total loss, the sheer volume of items you need to account for can feel overwhelming. Without a structured way to document everything, it’s all too easy to forget significant possessions, leading to an underpaid claim. Insurance adjusters work with the information you provide, and if that information is incomplete or vague, your payout will reflect that. A meticulously detailed inventory acts as your personal advocate, ensuring every lost item is considered.

Imagine trying to list every shirt, every book, every kitchen utensil, or every tool in your garage from memory, days or weeks after a devastating event. It’s an exercise in frustration and often leads to significant oversights. These forgotten items, big or small, add up quickly. Furthermore, a detailed list can help prevent disputes with your insurance company by providing clear, organized evidence of your losses, which streamlines the negotiation process and helps you move towards recovery faster.

Beyond the financial aspect, creating or updating your inventory before a loss, or even right after, provides a small but significant sense of control in an otherwise chaotic situation. It allows you to systematically approach a monumental task, breaking it down into manageable steps. This methodical process can help reduce anxiety and stress, giving you a clear path forward when everything else feels uncertain.

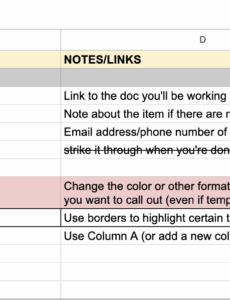

Your inventory isn’t just a list of names; it’s a comprehensive record designed to paint a clear picture of your lost assets. To be truly effective, it needs to go beyond basic descriptions and incorporate specific details that insurance providers require for valuation.

What to Include in Your Inventory

- Item Description: Be as specific as possible. Instead of “TV,” write “55-inch Samsung Smart 4K UHD TV.”

- Quantity: How many of each item did you lose?

- Purchase Date: Approximate date of purchase if you don’t have the exact one.

- Original Cost: The price you paid when you bought the item.

- Estimated Replacement Cost: How much would it cost to replace the item today with a new, similar item?

- Condition Before Loss: Describe its condition (e.g., “new,” “excellent,” “good,” “worn”).

- Supporting Documentation: Note if you have photos, videos, receipts, appraisals, or warranties for the item. These are incredibly valuable for substantiating your claim.

Maximizing Your Recovery: How to Effectively Use and Customize Your Total Loss Inventory List Template

Once you have a total loss inventory list template, the real work begins: filling it out accurately and comprehensively. The most effective way to tackle this, especially for homes, is to go room by room. Start in one area – say, the master bedroom – and meticulously list every item. Then move to the next room, ensuring you don’t miss anything. For vehicles, you might categorize items by type: electronics, tools, personal items, car accessories, etc. This systematic approach helps prevent omissions and keeps the process organized.

Accuracy is paramount. While it might be tempting to inflate values, being truthful and providing verifiable information will serve you best in the long run. Gather all supporting documents you can find: receipts, credit card statements, bank statements showing purchases, owner’s manuals, and even old photographs or videos of your property. These pieces of evidence transform your inventory from a mere list into undeniable proof, significantly strengthening your claim and potentially speeding up the approval process.

Remember that different types of items might require different levels of detail. High-value items like electronics, jewelry, art, or specialized equipment warrant particular attention. For these, detailed descriptions, serial numbers, and professional appraisals (if available) are invaluable. For everyday items like clothing or kitchenware, you can often group similar items together (e.g., “10 pairs of jeans,” “set of 8 dinner plates”) but still provide a reasonable estimate of their collective value and condition.

A generic total loss inventory list template provides a fantastic starting point, but it’s important to remember that it’s just a framework. You’ll need to customize it to fit your unique situation and possessions. If you have a home office, ensure there’s space for office equipment and supplies. If you collect specific items, create a dedicated section for them. Don’t hesitate to add columns or rows if you feel certain details are missing that are relevant to your particular losses. The more tailored the template is to your life, the more effective it will be.

Preparing for the unexpected is never easy, but equipping yourself with the right tools can make an immense difference when disaster strikes. A well-organized, thoroughly completed inventory list is more than just paperwork; it’s a detailed account of your life’s possessions. This proactive step not only aids in securing a fair insurance settlement but also provides a structured way to navigate the often-overwhelming recovery process.

By taking the time to compile or update such a list, you’re not just documenting items; you’re safeguarding your financial future and streamlining your path back to normalcy. It’s a testament to preparedness that ensures you can focus on rebuilding your life with the necessary resources, rather than struggling to recall every lost memory and possession.