Navigating a divorce is undeniably one of life’s most challenging experiences. Amidst the emotional turmoil and significant life changes, one practical task stands out as crucial for ensuring a fair and equitable outcome: dividing your marital assets. This process can feel incredibly overwhelming, especially when you’re dealing with a complex financial picture or a long marriage.

However, an organized approach can make a world of difference. Creating a clear, comprehensive asset list is not just a tedious chore; it’s an essential step that provides clarity, minimizes potential disputes, and forms the bedrock for any negotiation or legal settlement. It helps ensure that nothing important is overlooked and that both parties have a transparent view of the shared financial landscape.

Why an Organized Asset List is Indispensable for Your Divorce

When you’re facing a divorce, the idea of meticulously listing every single item you and your spouse own might seem daunting. Yet, this is precisely why having an organized asset list is absolutely critical. Without a clear inventory, the division of property can quickly devolve into confusion, arguments, and protracted legal battles, costing you both time, money, and emotional energy. A well-prepared list streamlines the entire process, making it more efficient and significantly less stressful for everyone involved.

Consider the alternative: trying to recall every bank account, investment, piece of real estate, or even significant personal possession from memory during an already fraught time. It’s almost impossible to do accurately, leading to oversights that could cost you substantially in the long run. An asset list acts as your financial roadmap, ensuring that every piece of the marital pie is accounted for, valued, and ultimately distributed fairly.

Furthermore, your legal team or mediator will rely heavily on this document. It provides them with the concrete information they need to advocate on your behalf, assess potential settlement options, and navigate complex financial disclosures. Providing them with a structured list from the outset saves considerable time and resources, allowing them to focus on strategy rather than discovery. This proactive step puts you in a much stronger position during negotiations.

Ultimately, an organized asset list empowers you to take control of your financial future during a time when much might feel out of your control. It helps you understand exactly what you have, what it’s worth, and how it might be divided, laying a solid foundation for your next chapter. This is where an asset list template for divorce becomes incredibly valuable, guiding you through what to include.

Key Categories to Include in Your Asset List

To ensure your asset list is truly comprehensive, it’s helpful to break it down into distinct categories. This not only makes the process of gathering information more manageable but also ensures no major area is overlooked.

- Real Estate: This includes your primary residence, vacation homes, rental properties, and any undeveloped land. Be sure to include addresses, estimated market values, and any outstanding mortgage balances.

- Financial Accounts: List all checking accounts, savings accounts, money market accounts, certificates of deposit (CDs), and brokerage accounts. Include bank names, account numbers, and current balances.

- Investments: Detail any stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other investment portfolios. Include the institution, account numbers, and current values.

- Retirement Accounts: Do not forget 401(k)s, 403(b)s, IRAs (Traditional and Roth), pensions, and any other retirement savings plans. These often represent significant assets.

- Vehicles: List all cars, trucks, motorcycles, boats, RVs, and any other motorized vehicles. Include make, model, year, VIN, and estimated current value.

- Personal Property: This category covers valuable items like jewelry, art collections, antiques, high-value furniture, and other significant household items. For less valuable items, a general estimate of household goods might suffice.

- Businesses: If either spouse owns a business or has an ownership interest in one, this needs to be included. Business valuations can be complex and often require professional appraisal.

- Debts: While technically liabilities, it’s crucial to list all outstanding debts, such as mortgages, car loans, personal loans, student loans, and credit card balances, as they directly impact the net value of your assets.

Crafting Your Comprehensive Asset List: A Practical Guide

Once you understand the importance of an asset list, the next step is to actually create it. This might feel like a monumental task, but by breaking it down into manageable steps, you can systematically build a thorough and accurate document that will serve you well throughout your divorce proceedings. Think of it as an ongoing project rather than a one-time sprint.

Start by gathering all relevant financial documents. This includes bank statements, investment account statements, tax returns from the past several years, property deeds, vehicle titles, loan documents, mortgage statements, credit card statements, and any prenuptial or postnuptial agreements. Having these documents organized and readily accessible will make populating your asset list significantly easier and more accurate.

Next, begin listing everything you and your spouse own, both jointly and individually. Do not censor or omit anything at this stage, even if you are unsure of its value or whether it’s truly a marital asset. It’s better to be overly inclusive and then refine the list later. For each item, try to note down its description, the date it was acquired (this is important for determining if it’s marital or separate property), its estimated current value, and any outstanding debt associated with it.

Finally, dedicate time to researching or obtaining valuations for each asset. For real estate, you might use online valuation tools, consult with real estate agents, or, for a more definitive figure, obtain a professional appraisal. Vehicles can be valued using online resources like Kelley Blue Book or NADA Guides. For investments, current statements provide market values. For businesses or complex assets, a professional valuation expert is usually necessary. Remember to update these values periodically, as markets can change.

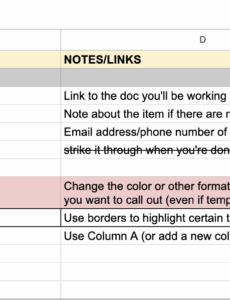

- Asset Description: A clear and concise name for the item (e.g., “Primary Residence,” “Bank of America Checking Account”).

- Date of Acquisition: When the asset was purchased or acquired, helping determine if it’s marital or separate property.

- Current Estimated Value: The fair market value of the asset as of a recent date.

- Outstanding Debt: Any loans or mortgages tied directly to the asset.

- Account Number or Identification: Relevant numbers to easily identify the asset.

- Supporting Documentation: A note on where the supporting documents (statements, deeds) are located.

Taking the time to meticulously prepare an asset list provides a sense of control and clarity during an otherwise chaotic period. It transforms a potentially overwhelming task into a structured and achievable goal, empowering you to move forward with confidence. This foundational work will significantly ease the burden of negotiations and legal processes, allowing you to focus on rebuilding your life.

Embracing this crucial step means you are actively shaping your future, ensuring that the division of your shared life is handled with the fairness and diligence it deserves. It’s an investment in your peace of mind and financial stability as you transition to your next chapter.